Customized Equity Investing

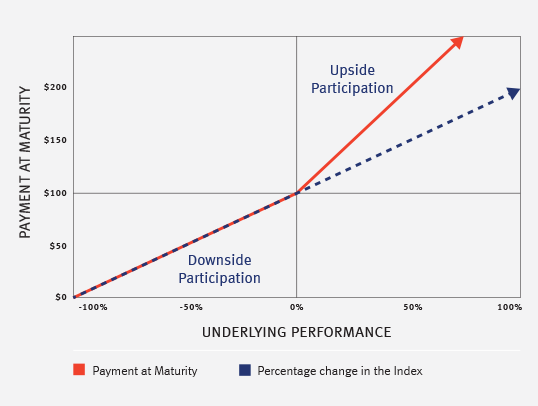

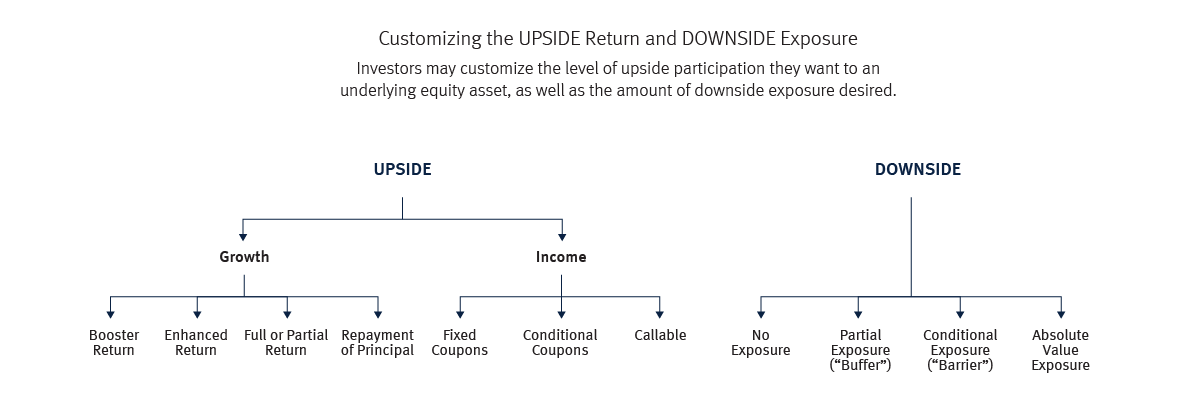

ELNs deliver tailored exposure to equity markets. For markets with expected growth, clients may consider notes that provide an accelerated or boosted return. These products provide enhanced participation in the positive performance of a selected equity market. For investors that require income, notes that pay fixed or conditional coupons at above-market rates may be appropriate.

Risk Tolerance

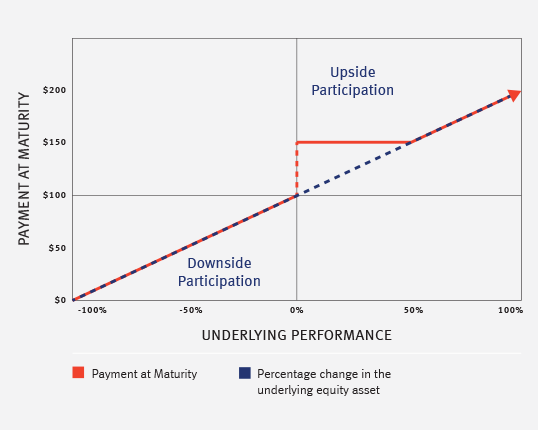

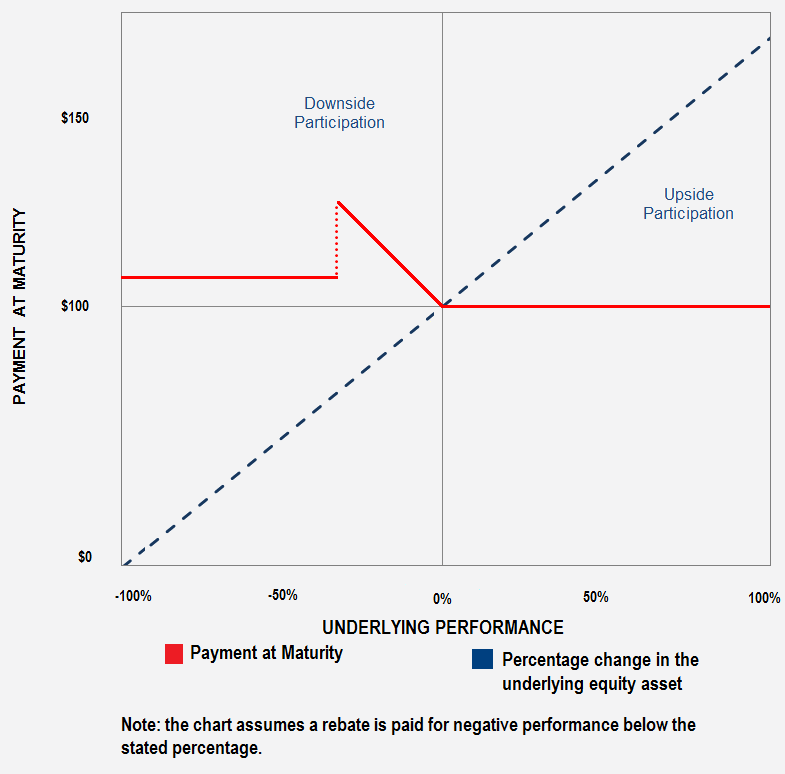

ELNs are created to accommodate a variety of risk tolerance levels. Notes can be designed to provide partial or conditional downside exposure while still offering upside return in positive markets.

Flexible and Timely Issuance Based on Current Market Conditions

ELNs can be customized and made available for purchase within a short time frame, typically a few days. Clients can choose to participate in ELNs when it best suits their investment outlook.

Transparent, Passive and Formulaic

The return on the ELNs is based on a defined payment formula applied to the performance of an underlying asset. The current performance of the underlying asset can be observed throughout the term of the ELN. The return formula is pre-determined before note issuance and the return calculation is therefore transparent.

Some key risk considerations include, but are not limited, to the following:

- ELNs are senior debt obligations of the issuer of the ELN. Therefore, returns are dependent on the issuer’s ability to pay. Any secondary market prices will typically decrease if the issuer’s credit risk increases.

- Depending on the structure, investors may lose all or a part of their initial investment based on the performance of the underlying equity asset.

- Return formulas are pre-defined and cannot be changed during the term of the note.

- Returns could be less than traditional debt securities.

- Returns may be capped (depending on the structure).

- Although investors might hold a note linked to an underlying equity asset that generates dividends, ELN investors most often do not receive the benefit of these dividends (depending on individual note features).

- A secondary market for ELNs is not guaranteed. The price at which ELNs can be sold in the secondary market, if any, prior to maturity may be at a substantial discount from the investor’s initial investment.

- Typically, the market value of an ELN will only fully reflect the return formula at or close to maturity. Prior to maturity, a variety of factors may cause the market value of an ELN to be less than the principal amount, or less than the amount that may be expected to be paid at maturity.

How it works

Choosing an Equity Linked Note

ELNs are created based on the investment preferences of clients. Investors can choose from notes with a growth or income focus, based on their personal requirements.

- This communication has been generated by RBC Capital Markets’ Global Equity Linked Products and is not a research report or a product of RBC Capital Markets’ Research Department.

- These materials are for informational purposes only and do not contain all information that may be required to evaluate, and do not constitute a recommendation with respect to, any investment. Any recipient of these materials should conduct its own independent analysis of the matters referred to herein. Investors must consult with their own advisors prior to investing. We are not providing you with any accounting, legal or tax advice in connection with these materials.

- Before a potential investor can purchase any structured notes, they must have completed account opening procedures and have executed relevant documentation. Prior to investing in a structured note, a potential investor will need to carefully review the relevant offering documents to fully understand the investment and the potential risks. Please revise the “Additional Risk Considerations” tab for important risk factors that investors should consider in connection with the investments discussed on this website.

- The information and any analyses contained in this document are taken from, or based upon, information from publicly available sources, the completeness and accuracy of which has not been independently verified. The information and any analyses in these materials are subject to change with changing market conditions.

- Any examples, calculations or value ranges indicated herein are hypothetical and should not be construed as indicative of levels at which an issuer may issue a product.

- RBC Capital Markets is the global brand name for the capital markets business of Royal Bank of Canada and its affiliates, including RBC Capital Markets, LLC (member FINRA, NYSE and SIPC); RBC Dominion Securities Inc. (member CIRO and CIPF); Royal Bank of Canada - Sydney Branch (ABN 86 076 940 880); RBC Capital Markets (Hong Kong) Limited (regulated by the Securities and Futures Commission of Hong Kong and the Hong Kong Monetary Authority) and RBC Europe Limited (authorized by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority.)

- ® Registered trademark of Royal Bank of Canada. Used under license. All rights reserved.

An investment in ELNs involves significant risks. These risks are explained in more detail in the applicable offering documents for a specific offering. Before investing in an ELN, investors should carefully read the relevant offering documents to ensure they understand all of the potential risks. Some general risk considerations for ELNs include, but are not limited to the following:

- ELNs are unsecured debt obligations of the relevant issuer. Investors are dependent on the ability of the issuer to pay all amounts due on the notes, and therefore, investors are subject to the relevant issuer’s credit risk and to changes in the market’s view of the creditworthiness of the relevant issuer.

- Depending on the structure, investors in an ELN could lose some or their entire principal if there is a decline in the underlying equity asset. Even for structures that offer limits on downside exposure, the return of principal will depend on the relevant issuer’s ability to pay its obligations at the relevant time.

- Some structures pay a variable or contingent coupon based on the performance of the underlying equity asset. This coupon may fluctuate over time and potentially be zero for some or all of the ELN’s term. In some structures, the coupon may be the only return an investor will be entitled to for the ELN.

- For structures that are subject to redemption prior to maturity, if the ELNs are called before maturity, an investor will not receive any further coupons and may not be able to reinvest the proceeds from the call in an investment with a comparable return had the ELNs not been called.

- For Bear Notes, investors will generally not participate in the positive performance of an underlying equity asset. Such notes are not designed for investors who seek an investment linked to the positive performance of the relevant asset.

- ELNs are typically sold at par and include fees and costs such as commissions, hedging costs and projected profits of the relevant issuer or its affiliates. Therefore, the estimated initial value of a ELN on the pricing date will be less than the issue price investors pay for the ELN.

- The offering documents of an ELN will typically include the issuer’s initial estimated value of the ELN. This estimated value does not represent the future value of the ELN.

- ELNs will not be listed on any securities exchange. While the relevant issuer or its affiliate will generally endeavor to maintain a secondary market, they are not obligated to do so. The issuer or its affiliate may cease any market-making activities at any time. Even if a secondary market for the ELNs develops, it may not provide significant liquidity or trade at prices advantageous to the investor.

- The price at which an investor may be able to sell ELNs prior to maturity, if at all, may be at a substantial discount from the principal amount of the ELNs, even in cases where the closing price of the underlying equity asset has appreciated since the trade date. In addition, investors will not receive the benefit of any contingent repayment of principal if they sell ELNs before the maturity date. The potential returns described in the relevant offering documents assume the ELNs, which are not designed to be short-term trading instruments, are held to maturity.

- The return on ELNs may be lower than the return an investor could earn on other investments during the same term. Even if the return on an ELN is positive, it may be less than the return an investor could earn if it bought a conventional debt security of the relevant issuer.

- Investing in ELNs is not the same as owning the underlying equity asset (or any security or other component including in the underlying equity asset) directly. For instance, investors usually will not receive or be entitled to receive any dividend payments or other distributions on the underlying equity asset. Investors will also not have any voting rights or any other rights that a holder of the underlying equity asset may have.

- The activities of the relevant issuer or its affiliates may conflict with an investor’s interests and may adversely affect the value of the ELNs.

- Many economic and market factors will influence the value of the ELNs, including but not limited to, interest and yield rates in the market, time to maturity of the ELNs, expected volatility of the underlying equity asset, and economic, financial, political, regulatory or judicial events.

- While the offering documents will typically contain a summary of the expected U.S. federal income tax consequences of an investment in the ELNs, significant aspects of the tax treatment of the ELNs may be complex and uncertain. Prospective investors should consult with their tax advisor before investing in any ELN to determine the effects based on their individual circumstances.